Since their debut in the late 1970s, Van Halen has become one of the best-selling bands of all time, selling over 56 million albums in the US alone. Their music defined a genre (and a generation), and inspired countless musicians to follow in their footsteps. But, their impact reaches much further than the music world. In fact, you could argue Van Halen’s reach extends even into the blockchain boom we’re seeing today. How so? Well, Van Halen sort of invented the smart contract. Let me explain.

By Colin Gounden

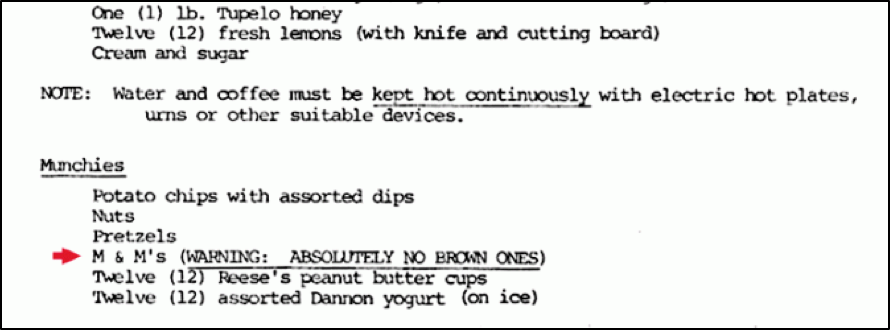

You may be familiar with one particular bit of lore from Van Halen’s long and storied career: the band’s brown M&M clause. In their 1982 world tour contract rider, which clocked in at an impressive 53 pages, Van Halen specified that in the bowl of M&Ms in their dressing room, there should be “ABSOLUTELY NO BROWN ONES.” Now, the rider also demands herring in sour cream and four cases of Schlitz Malt Liquor beer, so it’s easy to chalk up all this to diva-like antics. However, in his autobiography Crazy from the Heat, former frontman David Lee Roth shares insight into the genius behind this oddly specific request:

“Van Halen was the first band to take huge productions into tertiary, third-level markets. We’d pull up with nine eighteen-wheeler trucks, full of gear, where the standard was three trucks, max. And there were many, many technical errors — whether it was the girders couldn’t support the weight, or the flooring would sink in, or the doors weren’t big enough to move the gear through.”

Roth goes on to explain that because their equipment needed to be handled with such specific care in order to ensure the safety of band and audience members alike:

“[…] as a little test, in the technical aspect of the rider, it would say “Article 148: There will be fifteen amperage voltage sockets at twenty-foot spaces, evenly, providing nineteen amperes . . .” This kind of thing. And article number 126, in the middle of nowhere, was: “There will be no brown M&M’s in the backstage area, upon pain of forfeiture of the show, with full compensation.” So, when I would walk backstage, if I saw a brown M&M in that bowl . . . well, line-check the entire production. Guaranteed you’re going to arrive at a technical error. They didn’t read the contract. Guaranteed you’d run into a problem. Sometimes it would threaten to just destroy the whole show. Something like, literally, life-threatening.”

Not divas at all, Van Halen used this M&M clause as a way to test that their equipment, their band members, and their audience were safe. And their if/then logic (if there are brown M&Ms in the bowl, then the contract wasn’t read carefully) is similar to how the smart contracting functionality of blockchain platform Ethereum works as well.

Similar to traditional contracts, Ethereum smart contracts set specific rules around how users can interact with each other and exchange items of value (e.g., money, information, or property, like band equipment). What makes smart contracts different than their traditional counterparts is their ability to code these rules into a secure blockchain and automatically enforce them. So, transactions on Ethereum can only happen if the specific parameters within the smart contract are met. For example, if Van Halen’s contract rider existed on Ethereum, the band could rest assured knowing that their equipment had only been handled by those who had followed the exact parameters of their contract.

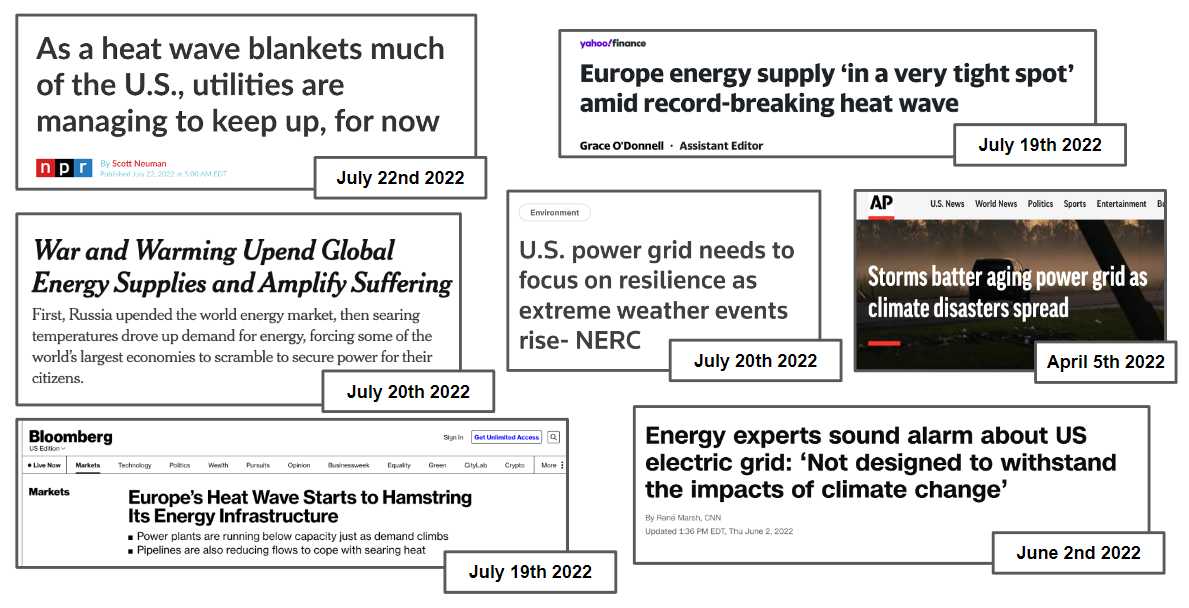

Let’s face it: we’re not all rockstars like Van Halen and blockchain isn’t exactly a consumer technology (at least, not yet), so who does smart contracting benefit? Well, for starters: high-stakes industries like energy that historically haven’t been able to implement AI initiatives because of data security concerns. AI needs lots of data to make predictions, so for companies with highly confidential data, like utilities, lack of secure access to data has been a major blocker for AI. Smart contracting has the potential to spark a massive AI revolution in the industry, and that’s a really big deal.

Let’s say Utility A wants to predict when their transformers might fail. To do this, they would need to provide AI Solution Provider B with data like the exact latitude and longitude of every transformer they operate. This kind of information is incredibly sensitive (and oftentimes, a matter of national security), so without a secure way to share it, utilities could not provide the data necessary for a solution provider to build a customized AI algorithm. However, Ethereum could provide a platform for blockchain-based applications that set specific restrictions around how data can be accessed. In that case, Utility A could set the rule: AI Solution Provider B can access Data C for Purpose D, thus protecting their data from malicious actors or requests.

The potential impact of AI in energy is extraordinary. From predictive maintenance to resiliency planning to grid modernization, AI can improve the reliability and efficiency of operations and service of utilities across the world. And while adopting new technology like blockchain can be daunting for any industry, think of Van Halen’s question from one of their most recent hits: When was the last time you did something for the first time?